Be Part of the Legacy

It’s time to step forward and build a legacy that connects our past to our future and our communities to each other.

Together, with your help, we are building a world-class rail-trail that connects our past to our future, our communities to each other, our economies to opportunities and our population to healthy lifestyles.

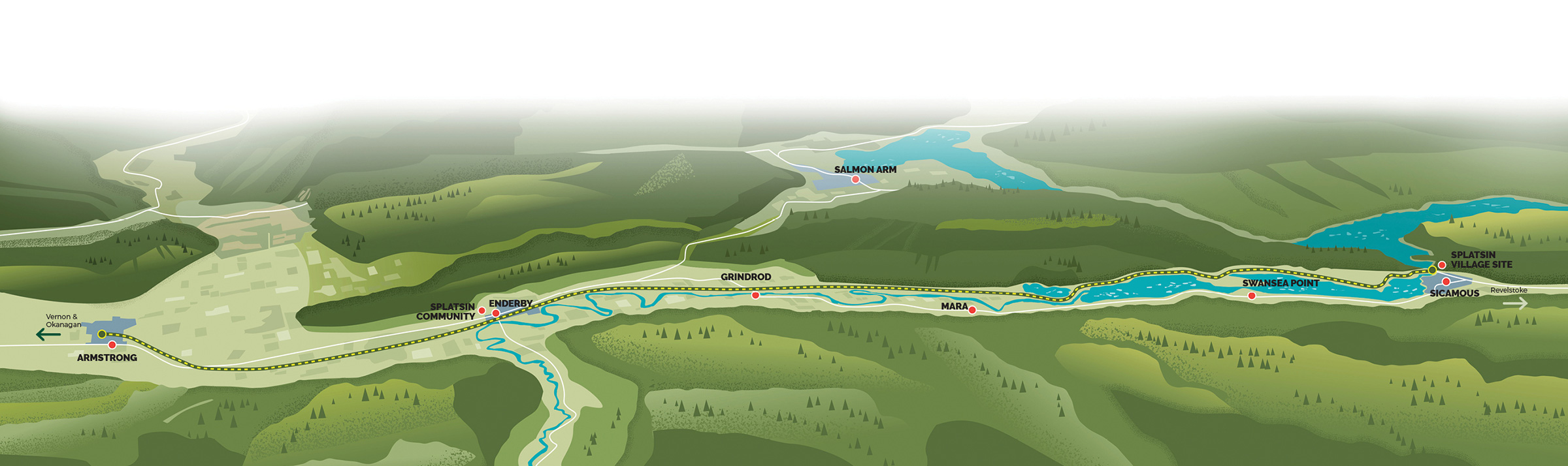

The Shuswap North Okanagan Rail Trail provides a connection between communities unfolding the true story within Secwépemc territory, protecting natural areas and habitat for wildlife, facilitating healthy outdoor recreational activities and travel options on foot and by bicycle, conserving heritage, cultural, & agricultural values, and encouraging recreational tourism in rural areas.

At just over 50 kilometres long, it will create a perfect opportunity for families to discover scenic landscapes with amenities along the way.